Page 5 - Investor-Navigator

P. 5

Section 02

UAE Economic Diversification Policy

UAE The UAE has a clear and comprehensive vision With its economic diversification policy – which

is reducing dependence on oil revenues – the UAE

to diversify its economy and achieve an optimal

ECONOMY balance between various economic sectors to ensure gears to be more flexible in adopting new economic

sustainability and create new business opportunities.

models, and seeks to be ever proactive in capitalizing

As much as enhancing the UAE’s competitiveness in on regional and global economic partnerships to

the global economic front, the move to creating a ensure sustained prosperity. The policy also focuses

solid foundation of the post-oil era – by diversifying on investing in non-oil sectors such as infrastructure,

The UAE’s competitiveness rating was supported the economy and strengthening trade – will ensure a technology, aviation, tourism, healthcare, and

by strong rankings in infrastructure, goods sustainable economy for generations to come . education, among others.

and market efficiency, labor market efficiency,

financial market development, business The UAE had already reaped the rewards of this

sophistication and the country’s macroeconomic The UAE aims to increase the share of its non-oil real strategy: even when oil prices began falling in 2014, the

environment, among other factors. For instance, GDP to 80%, by 2021. As a result, government spending non-oil GDP growth of the UAE in the same year was

under the ‘Overall Competitiveness Index’, the and investment opportunities in non-oil sector will at an impressive 8.1%, surpassing as well the country’s

UAE earned the first place on the ‘Efficiency continue to accelerate. overall GDP growth. In 2016, non-oil sectors account

of Government Spending Index’, having been for more than 80% of the total UAE GDP.

consistently ranked second for the last three

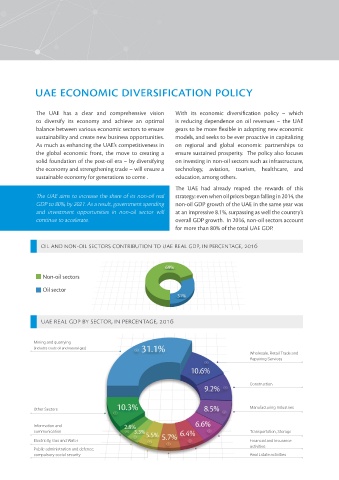

years . Oil and Non-Oil Sectors Contribution to UAE Real GDP, in Percentage, 2016

The solid economy of the UAE and its strong

GDP figures bring the UAE to the level of many

advanced economies. Non-oil sectors

Oil sector

The UAE is a high-income country, and one of the Although the backbone of the UAE economy is

richest and fastest growing economies in the world. the production and export of oil and gas - with

It is also the second largest in the Arab world. The resources equivalent to the world’s seventh UAE Real GDP by Sector, in Percentage, 2016

International Monetary Fund (IMF) projected a 3.4% largest proven crude oil reserves - aviation,

increase in the UAE’s real Gross Domestic Product shipbuilding, manufacture of construction

(GDP) in 2018, in comparison to 1.3% in 2017. The materials and aluminum, textile industry, Mining and quarrying

organization has also expected the growth of UAE’s tourism, real estate, trade and many other key (includes crude oil and natural gas)

real oil GDP to reach 3.2% in 2018, while the non-oil sectors make significant contribution to the Wholesale, Retail Trade and

Repairing Services

sector growth will reach 3.4% in 2018 in contrast to economic development of the country.

3.3% in 2017.

10

With the UAE’s solid and diversified economy, and Construction

A rendering of this economic strength in the a sustainable development future, the country is

regional and international space, the UAE is the most favored by investors for its open economy, large

competitive economy in the Arab region, and ranks positive surplus, ultra-modern and multi-modal Other Sectors Manufacturing Industries

17th globally, among 137 countries according to the infrastructure, strategic location and access

Global Competitiveness Report for 2017 issued by the to markets, encouraging business climate and,

World Economic Forum (WEF). 11 among others, high standards of living. Information and Transportation, Storage

communication

Electricity, Gas and Water Financial and Insurance

activities

Public administration and defence;

compulsory social security Real Estate activities